Urban small-wheel scooters and large-displacement motorcycles live in different engineering worlds, and that matters when you’re building SKU ladders, pricing bands, and service models. This guide translates the category differences into practical product-line rules for OEM/ODM programs and distributor portfolios.

TL;DR: Scooters prioritize cost control and low-maintenance comfort on 10–14 inch wheels with short travel and minimal adjustability; big bikes require longer travel, cartridge damping, and often electronic options to handle higher speeds and payloads. Plan your suspension SKUs and margins around that cost–performance–adjustability ladder.

Version and pricing scope

- Category-level comparison as of 2026-01-26. Indicative ex-works price bands in USD; ranges vary by region/spec and are not brand-specific.

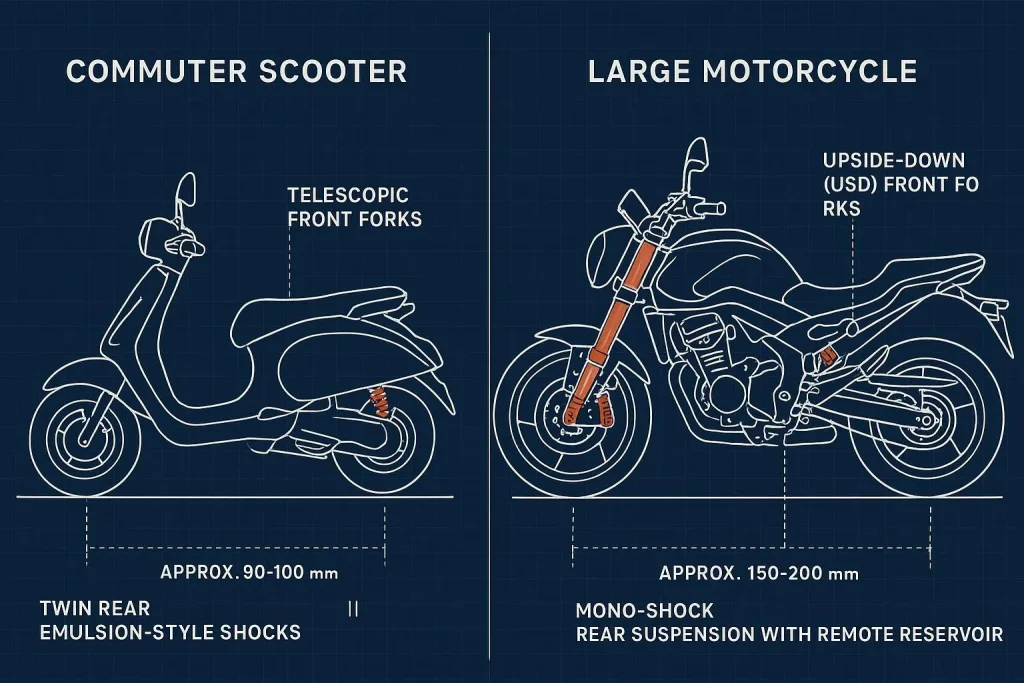

Scooter vs motorcycle suspension — the big-picture differences

The two platforms diverge on wheel size, travel, damping architecture, duty cycle, and service model. Those technical realities dictate your tiering and economics.

| Dimension | Commuter scooters (urban small-wheel) | Big bikes (large-displacement street/touring) |

|---|---|---|

| Typical wheel size | 12–14 in common; e.g., the 2024 Honda PCX runs 14 in front/13 in rear | 17–21 in fronts (application-dependent) and 17–18 in rears; ADV and touring skew larger |

| Typical travel (front/rear) | ~85–100 mm / ~85–100 mm in mainstream city models | ~130–200 mm total range depending on class; ADV and premium tourers near the upper end |

| Damping architecture | Short-travel telescopic forks, twin-shock rears, emulsion-type; few external adjusters at entry | USD or advanced telescopics with cartridges; mono-shocks with reservoirs; multi-way external adjusters are common from mid-tier up |

| Adjustability ladder | None → preload-only → basic rebound (select mid-tier aftermarket) | Preload → rebound → compression (single/hi-low) → semi-active/electronic on premium trims |

| Load/speed duty cycle | Solo to light cargo; stop–start urban speeds; smaller oil volumes prioritize comfort over heat management | Two-up + luggage; sustained highway speeds; higher heat and load management requirements |

| Service model | Mostly sealed, replace-only assemblies for OEM units | Rebuildable shocks and serviceable cartridge forks are the norm from mid-tier upward |

| Indicative ex-works price bands (as of 2026-01-26) | Basic rear pair $25–$60; mid $60–$120; premium $120–$220 | Basic/emulsion rear $90–$180; mid (reb/preload or R+C) $180–$400; premium reservoir or electronic-ready $400–$1,200+ |

| SKU strategy implication | Emphasize volume coverage, swap-friendly units, and 2–3 clear price steps | Emphasize performance tiers, adjustability choices, and service/rebuild ecosystem |

Evidence highlights: The 2024 Honda PCX confirms small-diameter wheels and short travel suitable for urban bumps, while big-bike platforms like the BMW R 1300 GS, Yamaha Tracer 9 GT+, and Ducati Multistrada V4 demonstrate longer travel, cartridge damping, and semi-active options (Honda PCX 2024 specifications; BMW R 1300 GS technical data and DSA, 2024; Yamaha Tracer 9 GT+ KYB KADS features, 2024; Ducati Multistrada V4 DSS Skyhook electronics, 2024–2025). OEM scooter documentation also treats shocks as replaceable assemblies rather than rebuildable components (see the Vespa Primavera service manual section).

How to build the product line for each platform

The cost–performance–adjustability ladder is your blueprint. Think of it this way: each rung adds capability and price; your job is to match rungs to your market’s duty cycle, service capacity, and margin targets. This is the core of scooter vs motorcycle suspension planning for OEM/ODM and distributors.

Commuter scooters (urban small-wheel)

For scooters, lead with coverage and simplicity. Short travel and small wheels favor comfort-oriented damping with limited heat loads; customers value low downtime over deep tunability. Start with an entry tier that is genuinely affordable and stockable, then add one or two steps for channel differentiation.

Basic (coverage-first): Offer sealed twin-shock pairs with fixed damping or preload-only, tuned for solo riders and light cargo. Keep hardware uniform and fitment precise to speed swaps for fleets. Indicative ex-works: $25–$60 per pair (as of 2026-01-26). Lead times can be short if you standardize bodies and vary springs.

Mid (value uplift): Introduce preload and basic rebound options with improved oil and seals to maintain comfort across more rider weights. Aim these at retail upgrade customers and delivery riders carrying moderate loads. Indicative ex-works: $60–$120 per pair. Warranty handling should remain swap-based to reduce bench time.

Premium (brandable comfort): Add better bushings, progressive springs, and more precise rebound control; aesthetic options (e.g., anodized caps) help retail positioning. Keep service model “replace on failure” unless your region supports rebuilds. Indicative ex-works: $120–$220 per pair. Use small-batch color/branding to create channel exclusives without changing the core BOM.

Execution notes: Because scooter shocks are typically replaceable assemblies in OEM manuals, design warranty flows and inventory plans around fast swaps. Maintain SKUs for popular models (PCX/NMAX/Vespa) in two or three spring rates to reduce returns from bottoming or topping complaints. For concrete examples of scooter-tiering strategies by platform family, see this internal overview of suspension programs for Yamaha scooters.

Big bikes (large-displacement street/touring)

For big bikes, performance and heat management drive design. Longer travel, heavier loads, and sustained speeds reward cartridge damping and external adjusters. Your tiers should step up tuning latitude, oil volume, and—in some markets—electronic control.

Basic (entry mechanical): Emulsion mono-shocks with remote or stepped preload and a solid baseline rebound tune. Good for commuters and light touring on mid-displacement bikes. Indicative ex-works: $90–$180 per unit (as of 2026-01-26). Keep these swap-friendly but offer spring-rate options.

Mid (multi-adjustable mechanical): Add external rebound and compression (single adjuster) with larger oil capacity or piggyback reservoir. Pair with cartridge fork kits for front-end control on performance models. Indicative ex-works: $180–$400 (rear); fork cartridges often sit higher in BOM due to machining precision requirements.

Premium (reservoir and electronic-ready): High- and low-speed compression adjustability, robust heat capacity, and interfaces aligned to OEM semi-active ecosystems where applicable. Position these for two-up touring, ADV, and sport-touring buyers who expect rebuildability and periodic service. Indicative ex-works: $400–$1,200+ (rear), depending on reservoir design and electronic provisions.

Execution notes: Many premium platforms ship with or support semi-active systems (e.g., Tracer 9 GT+, R 1300 GS, Multistrada V4). In regions with mature service networks, promote rebuild intervals and tuning packages to enhance lifetime value. Where service is scarce, bias your mix toward durable mechanical adjustables and maintain a supply of seal heads and spring options for quick turnarounds. For an overview of front-end options and manufacturing scope, see this technical page on front shock absorbers and fork assemblies.

Best-for scenarios and recommendations

Urban commuter fleets and delivery: Favor scooter Basic→Mid ladders. Short travel and city speeds make low-maintenance, swap-friendly pairs the economic winner. Keep two spring rates in stock to cover rider plus cargo variance.

Premium touring and highway stability: Choose big bike Mid→Premium tiers. Multi-adjustable shocks and cartridge forks deliver control under braking, heat management, and two-up comfort. If your market supports it, include an electronic option for load compensation and road-state adaptation.

Price-sensitive emerging markets: Build scooter portfolios around Basic with a narrow Mid step and avoid service-dependent SKUs. For big bikes, use durable entry mechanical shocks with solid rebound tunes and clear warranty swap procedures.

Performance aftermarket for enthusiasts: Stock big bike Mid and Premium. Riders will pay for rebound and compression control and can support rebuild cycles. Offer fork cartridges alongside rear shocks to balance chassis behavior.

Service-constrained regions: Use replaceable scooter assemblies and robust mechanical big-bike units. Carry springs, seal heads, and top-out bumpers as essential spares, but keep the default remedy as “swap not bench-rebuild.”

FAQ

Q: When does adding adjustability pay off on scooters? A: In city use, preload-only often covers most riders. Basic rebound adjustment earns its keep when loads vary day-to-day (delivery) or when road surfaces are jarring. Beyond that, extra adjusters add cost without proportional benefit on short-travel, small-wheel platforms.

Q: Why are big-bike shocks typically rebuildable while scooter shocks are replace-only? A: Big bikes operate with higher loads, longer travel, and sustained speeds, so larger oil volumes and serviceable internals help maintain performance and extend life. Many scooter OEM manuals specify replacement of the complete shock assembly rather than internal service, aligning with low downtime for fleets (see the Vespa Primavera service section linked above).

Q: Do I need cartridge fork kits on big bikes for street use? A: If your segment includes spirited riding, two-up touring, or heavy braking at speed, cartridge damping brings consistency and control you can feel. For commuting and moderate speeds, a well-tuned emulsion shock plus quality fork springs and oil can suffice at lower cost.

Q: How do wheel size and travel interplay across scooter vs motorcycle suspension? A: Smaller wheels react more sharply to bumps, and short travel limits how much energy can be managed. That’s why scooters focus on comfort tuning at low speeds. Larger wheels and longer travel on big bikes provide stability and heat capacity for highway and loaded touring.

Q: Is electronic or semi-active suspension worth adding to my premium tier? A: In touring and ADV segments, it can justify premium pricing by maintaining damping targets as loads and conditions change. Adoption is visible across major models in 2024–2025, including BMW R 1300 GS (DSA), Yamaha Tracer 9 GT+ (KYB KADS), and Ducati Multistrada V4 (DSS Skyhook), signaling buyer expectations in upper tiers.

Also consider

Disclosure: Kingham Tech is our product. For OEM/ODM programs that span scooters and big bikes, an end-to-end manufacturer with in-house CNC and anodizing plus QA lab validation often shortens iteration cycles and keeps finishes consistent. See the overview of customization and validation on the OEM/ODM partner page.

Version and evidence notes

- Wheel size and travel examples for scooters: 2024 Honda PCX factory specs (wheels and travel) confirm the small-wheel, short-travel city profile.

- Big-bike travel and electronic options are reflected in 2024–2025 model families including BMW R 1300 GS (DSA), Yamaha Tracer 9 GT+ (KYB KADS), and Ducati Multistrada V4 (DSS Skyhook);

- OEM scooter service approach as replaceable assemblies is documented in Vespa Primavera materials.

- Indicative ex-works price bands are synthesized from retail signals and BOM deltas; all ranges stated are indicative as of 2026-01-26 and vary by spec and region.

Here’s the deal: design your portfolio around real-world duty cycles. For scooters, win with coverage, fast swaps, and two clean value steps. For big bikes, win with travel, damping control, and—where your market supports it—rebuildability and electronics. Lock your SKU ladders now, then schedule validation (dyno curves + field hours), and align inventory to your service model so your margin story holds up at scale.